Announcing New Regulatory Commission ComoPonent¶

22 June 2022

Page Topics:

- Getting started

- Triggering Commission and Clawback

- Commission and Clawback Calculations

- Integrate Regulatory Commission

With the increased demand to allow for commission calculations, we have integrated ComoLife with ComoLedger to enable us to calculate the regulatory commission and link the commission calculations to the relevant ledger account according to the details specified in the Long-term Insurance Act, 1998 (Act no. 52 of 1988).

ComoCommission is based on the Act that defines the maximum commission that may be earned on policy's.

Product Packages

Policies in the ComoLife space are referred to as "product packages".

Policies supported

The current version of ComoCommission only supports individual, multiple premia policies.

Getting started¶

Dependencies¶

The upgrade to the existing ComoLife module created no new dependencies.

Known Issues¶

In the event of concurrent transactions involving the same product package, there is a chance of causing multiple or incorrect commissions on the product package.

Implement queue

We recommend the bespoke system implements a queue to ensure that concurrent transactions are not allowed.

Assumptions¶

The following assumptions are made for this upgrade of the existing ComoLife module:

- A product package contains a single PremiumPayer role

- When calculating the commissionable premium, only the premium value of the associated cover instances is considered. See Triggering Commission and Clawback regarding the premium difference.

- A product package contains a single LifeAssured role

- When calculating the life assured's age for the premium paying term the first LifeAssured role on the affected product package will be used.

- In the event "Ages" is used, the number of completed years or months are used.

- All calculations or based on the effective date of the product package change.

- If the product package has been lapsed, canceled, or closed, the product package premium has been set to 0.00.

- Ensure the commission generated on reactivation is correct.

Limitations¶

Currently, the ComoCommission section of the ComoLife module have the following limitations:

- Only the Long-term Insurance Act, 1998 (Act no. 52 of 1988), referred to as the Act, is supported.

- Only product packages with a policy type of "Individual Policy", as defined by the Act, are supported.

- Only product packages with a policy premium type of "Multiple Premium", as defined by the Act, are supported.

Triggering Commission and Clawback¶

To generate commission or clawback, the SyncWithCommission input value for the microflow SUB_ImportProductPackageFromAPI needs to be set to "True".

Since the previous product package change, the system will automatically calculate the premium difference, further referred to as the delta,. The delta is calculated using the cover instances assigned to the premium payer role on the given product package.

Product Package Status and the Triggering of Commission & Clawback¶

Generating Commission¶

| Product Package Status | Comment |

|---|---|

Active and NewStatus | If the delta is positive, the commission will be generated. If the delta is negative, a partial clawback will be generated. |

Lapsed and Cancelled | If the status is one of these, it will result in full clawback. |

Closed | If the status is Closed it will result in a full clawback of the commission generated, given that it has been set accordingly using the commission configuration. |

Incomplete and Not_taken_up | If the status is one of these, it will result in no changes, meaning that neither commission will be generated nor will clawback be triggered. |

no status | If the status is no status, it will result in an error. |

As mentioned in the assumptions, when the product package status changes to either lapsed, canceled, or closed, the premium of the specific product package must be set to zero (0.00) to ensure the correct commission is generated in the event of reactivation of the product package.

Generating Clawback¶

If the delta value is negative – or the product package status is either lapsed or canceled – clawback will be triggered. Using the commission configuration, the user can set whether product packages whose status changed to closed should be clawed back on. The system can accommodate two types of clawback:

Multiple partial clawback

There can be multiple partial clawbacks on a commission, given that the commission is still viable.

Commission & Clawback During Claims¶

Should a product package be regarded to be in an in-claim state, commission and clawback could still be triggered, given the requirements set out above. Due to the different rules that customers can have regarding a product package that can be regarded as being in-claim, the bespoke system needs to address the issue.

In general, when a product is claimed, it is recommended that the product package status should be closed. Should the closed status be inappropriate for the business use case, the synchronization with commission can be skipped by setting the SyncWithCommission input value for the microflow SUB_ImportProductPackageFromAPI to "False".

Commission and Clawback Calculations¶

Primary Commission Calculation¶

Primary commission means commission which is payable generally in respect of all policies in accordance with this Part other than secondary commission;

As per 3A-4.1(b) of the Act, the primary commission can be calculated as follows:

Cprimary = PCP X [12 X CP]

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| Cprimary | The primary commission value | The currency used by the relevant ComoLedger sub-ledger |

| PCP | The primary commission percentage. See calculation here. | Unitless/Percentage |

| CP | The commissionable premium | The currency used by the relevant ComoLedger sub-ledger |

Calculating Primary Commission Percentage¶

The same section of the Act also refers to the table within Annexure 1 of 3A of the Act, which limits the primary commission percentage.

The primary commission percentage can be calculated as follows:

PCP = min(3.25% X PPT, 85%)

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PCP | The primary commission percentage | Unitless/Percentage |

| PPT | The premium paying term. See calculation here. | Years |

Calculating the Premium Paying Term¶

Finally, the premium paying term, which the Act defines as "in relation to a multiple premium policy" means the whole period during which the several amounts of premium are payable" can be calculated as follows:

PPT = max(10, 75−LAA)

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PPT | The premium paying term. | Years |

| LAA | The life assured's age at the effective date of the change in the product package, assuming completed years | Years |

However, the Act does allow for cover periods that end before the maximum age of 75. For such instances, the term is not constrained to a minimum of 10 years, but rather to the given maximum term. Hence the equation can be amended:

| Premium Paying Term | Premium Paying Term [Maximum-Term] |

|---|---|

| PT = max(10, 75−LAA) | PPT=min(max(10, 75−LAA), MT |

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PPT | The premium paying term. | Years |

| LAA | The life assured's age at the effective date of the change in the product package, assuming completed years | Years |

| MT | The maximum-term as calculated by the bespoke system, see implementing maximum-term | Years |

Information

We only support one premium payer and the life assured per product package

Secondary Commission Calculation¶

Secondary commission means commission which is payable, in addition to the primary commission, in respect of certain policies, as provided in and subject to this

As per 3A-4.2 of the Act, the secondary commission may not exceed a third of the primary commission. Hence, the secondary commission can be calculated as follows:

Csecondary= ⅓ X Cprimary

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| Csecondary | The secondary commission value | The currency used by the relevant ComoLedger sub-ledger |

| Cprimary | The primary commission value | The currency used by the relevant ComoLedger sub-ledger |

Clawback Commission Calculation¶

As per 3A-5.2(a)(i), the following percentages are to be paid or are allowed to be retained:

| Policy age (Months) | Max primary commission payable (%) | Max primary commission clawback (%) | Max secondary commission payable (%) | Max secondary commission clawback (%) |

|---|---|---|---|---|

| 0-6 | 0.00 | 100.00 | N/A | 100.00 |

| 7 | 29.17 | 70.83 | N/A | 100.00 |

| 8 | 33.33 | 66.67 | N/A | 100.00 |

| 9 | 37.50 | 62.50 | N/A | 100.00 |

| 10 | 41.67 | 58.33 | N/A | 100.00 |

| 11 | 45.83 | 54.17 | N/A | 100.00 |

| 12 | 50.00 | 50.00 | N/A | 100.00 |

| 13 | 54.17 | 45.83 | 8.30 | 91.70 |

| 14 | 58.33 | 41.67 | 16.70 | 83.30 |

| 15 | 62.50 | 37.50 | 25.00 | 75.00 |

| 16 | 66.67 | 33.33 | 33.30 | 66.70 |

| 17 | 70.83 | 29.17 | 41.70 | 58.30 |

| 18 | 75.00 | 25.00 | 50.00 | 50.00 |

| 19 | 79.17 | 20.83 | 58.30 | 41.70 |

| 20 | 83.33 | 16.67 | 66.70 | 33.30 |

| 21 | 87.50 | 12.50 | 75.00 | 25.00 |

| 22 | 91.67 | 8.33 | 83.30 | 16.70 |

| 23 | 95.83 | 4.17 | 91.70 | 8.30 |

| 24 | 100.00 | 0.00 | 100.00 | 0.00 |

To simplify the table above, the clawback percentage of the primary commission is calculated as follows:

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PA | The change in the product package's age results in the commission being generated | Months |

Two decimal

The value for PA/24 X 100 is always rounded to 2 decimals when calculated.

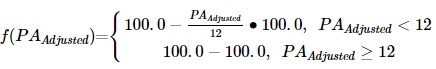

To simplify the table above, the clawback percentage of the secondary commission is calculated as follows:

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PAAdjusted | The change in the product package's age results in the commission being generated and adjusted for the secondary commission period. | Months |

One decimal

The value for PA/12 X 100 is always rounded to 1 decimal when calculated.

Where,

PA Adjusted = max(PA−12, 0)

Whereas,

| Symbol | Definition | Unit |

|---|---|---|

| PA Adjusted | The change in the product package's age results in the commission being generated and adjusted for the secondary commission period | Months |

| PA | The change in the product package's age results in the commission being generated | Months |

The clawback will only happen on viable commission. In other words, only the commission generated within the past twenty-four (24) months or the commission that has not been exhausted by previous (partial) clawbacks.

Partial Clawback Commission¶

Partial clawback is triggered when the policy's premium is reduced.

Partial clawback starts the clawback process on the latest viable commission. Should the latest viable commission's premium not be greater than the required clawbacks affected premium amount, the second latest viable commission will be clawed back as well.

This process will continue until either the full-premium reduction has been clawed back or there is no more viable commission left to be clawed back on.

Full Clawback Commission¶

The full clawback is triggered when the product package status is changed to lapsed, canceled, or, if set by the user, closed.

The full clawback will clawback all the viable commission as defined in the Act.

Integrate Regulatory Commission¶

Although ComoCommission is an upgrade to the existing ComoLife module, the following changes need to be made to make ComoCommission functional within a bespoke system, whether a new system or an existing system:

Allow synchronization with ComoCommission¶

ComoCommission will need to be synchronized when a product package is submitted or imported using the microflow SUB_ImportProductPackageFromAPI.

If the bespoke system validates if any synchronization should take place, then any change in the product package's premium value should trigger synchronization.

Schedule Ledgering of Commission and Clawback¶

ComoCommission uses bespoke systems' scheduled events to ledger the commission and clawback. This method removes the unnecessary resource usage for systems that do not require commission.

The microflows SCD_LedgerCommission and SCD_LedgerClawback can be added to a scheduled event in the bespoke system that handles the bespoke systems commission-related computations and processing.

If no such event exists, a newly scheduled event has to be created that should run at least once a day. For risk alleviation, it is recommended that the scheduled event run every 6 or 8 hours (3 – 4 times per day).

Allow User Access To ComoCommission Configuration¶

By either creating a new page or using the exiting SNP_CommissionConfig, give the user access to the ComoCommission configuration.

Access to configuration

We recommend that only a system administrator should have access to the configuration, as it may have a financial impact.

AWS SQS Queues¶

ComoLedger uses AWS SQS FIFO Queues to process its transactions. The SNS service must be enabled to notify when messages are moved over to the Dead Letter Queue (or DLQ).

It will be required to perform periodic monitoring of SQS and ComoLedger to ensure messages are being sent and received.

Rollback of Commission and Clawback¶

Currently, Comolife does not support rollback of product packages. However, should the bespoke system allow it, the commission and clawback can be rolled back by implementing the microflows SCD_RollbackCommission and SCD_RollbackClawback. These microflows will generate a scheduled process to write counter entries for the given CommissionGenerated and the given clawback.

Implementing the Maximum-Term¶

The maximum-term is a value calculated by the bespoke system to account for the scenario where the cover cease age is less than the maximum allowable age of 75, as defined by the Act.

The value is an integer that dictates the number of years that the life assured is covered. It is passed to the product package using the roduct package DTO.

- If the maximum-term is not applicable, a value of -1 should be used.

- If the maximum-term is negative or empty (except for -1), an exception will be thrown.

- If the maximum term indirectly causes the cover-ceases age to exceed the age of 75, the maximum ceases age; will be used in the calculations.

Refer to the section Premium paying term of this document for details on the calculation.

Before you go¶

This documentation portal has been created to be your right hand of guidance on this journey. We will be evolving the content from time to time and if there is any specific information you want us to add to improve your experience, please get in touch or send us a direct email to dash@comotion.co.za.

We love hearing from you!